In the intricate landscape of national product taxation, one name stands out as a beacon of expertise and reliability – Stpn – Servicos Tributarios Dos Produtos Nacionais Ltda. As businesses navigate the complexities of tax obligations, understanding the pivotal role that specialized tax services play becomes crucial. This article delves into the world of STPN, exploring its history, the spectrum of services it offers, its clientele, technological integration, and the unique solutions it provides. Join us on a journey through the corridors of STPN, where professionalism meets innovation to redefine the paradigm of tax services for national products.

History and Background of Stpn – Servicos Tributarios Dos Produtos Nacionais Ltda

Founded with a visionary spirit, STPN – Serviços Tributários dos Produtos Nacionais Ltda has deep roots in the realm of taxation. From its inception, the company aimed to unravel the complexities of national tax regulations, becoming a pivotal player in the field. Over the years, STPN has evolved, expanding its services from fundamental tax consultation to a comprehensive suite, including compliance services and strategic financial planning. This journey reflects not just a history but a legacy of adaptability and commitment, solidifying STPN’s standing as a trusted provider of tax solutions for national products.

Read More: rosane de fatima machado reckziegel – eireli ampere

Services Offered by Stpn – Servicos Tributarios Dos Produtos Nacionais Ltda

STPN – Serviços Tributários dos Produtos Nacionais Ltda is a trailblazer in providing a spectrum of services designed to simplify the intricate world of taxation for national products. From the foundational tax consultation that ensures a solid understanding of obligations to compliance services that navigate the ever-changing regulatory landscape, STPN stands as a comprehensive solution provider. The company goes beyond the ordinary, offering strategic tax planning that not only ensures compliance but also positions businesses for financial success. STPN’s commitment to excellence is evident in its diverse service portfolio, tailored to meet the unique needs of businesses, regardless of size or complexity.

Compliance with National Regulations

STPN – Serviços Tributários dos Produtos Nacionais Ltda places a paramount emphasis on compliance with national tax regulations. In the ever-evolving landscape of taxation laws, STPN remains vigilant, ensuring that businesses under their guidance not only meet but exceed compliance standards. The dedicated team at STPN stays abreast of legislative developments, providing clients with proactive advice to mitigate risks and safeguard their financial interests. By aligning seamlessly with national regulations, STPN not only ensures legal adherence but also fosters an environment where businesses can thrive with confidence, knowing their tax affairs are in capable and compliant hands.

Benefits of Using Stpn – Servicos Tributarios Dos Produtos Nacionais Ltda

Utilizing the services of STPN – Serviços Tributários dos Produtos Nacionais Ltda translates into a myriad of advantages for businesses navigating the complexities of national product taxation. The foremost benefit lies in financial advantages, as STPN’s expertise ensures optimal tax structures, minimizing liabilities, and maximizing returns. Beyond monetary gains, businesses partnering with STPN experience legal security, knowing that their tax affairs are in the hands of professionals well-versed in national tax laws. STPN’s commitment to excellence, coupled with a personalized approach, not only ensures compliance but transforms the taxing journey into a strategic advantage for businesses, fostering long-term success in the competitive market.

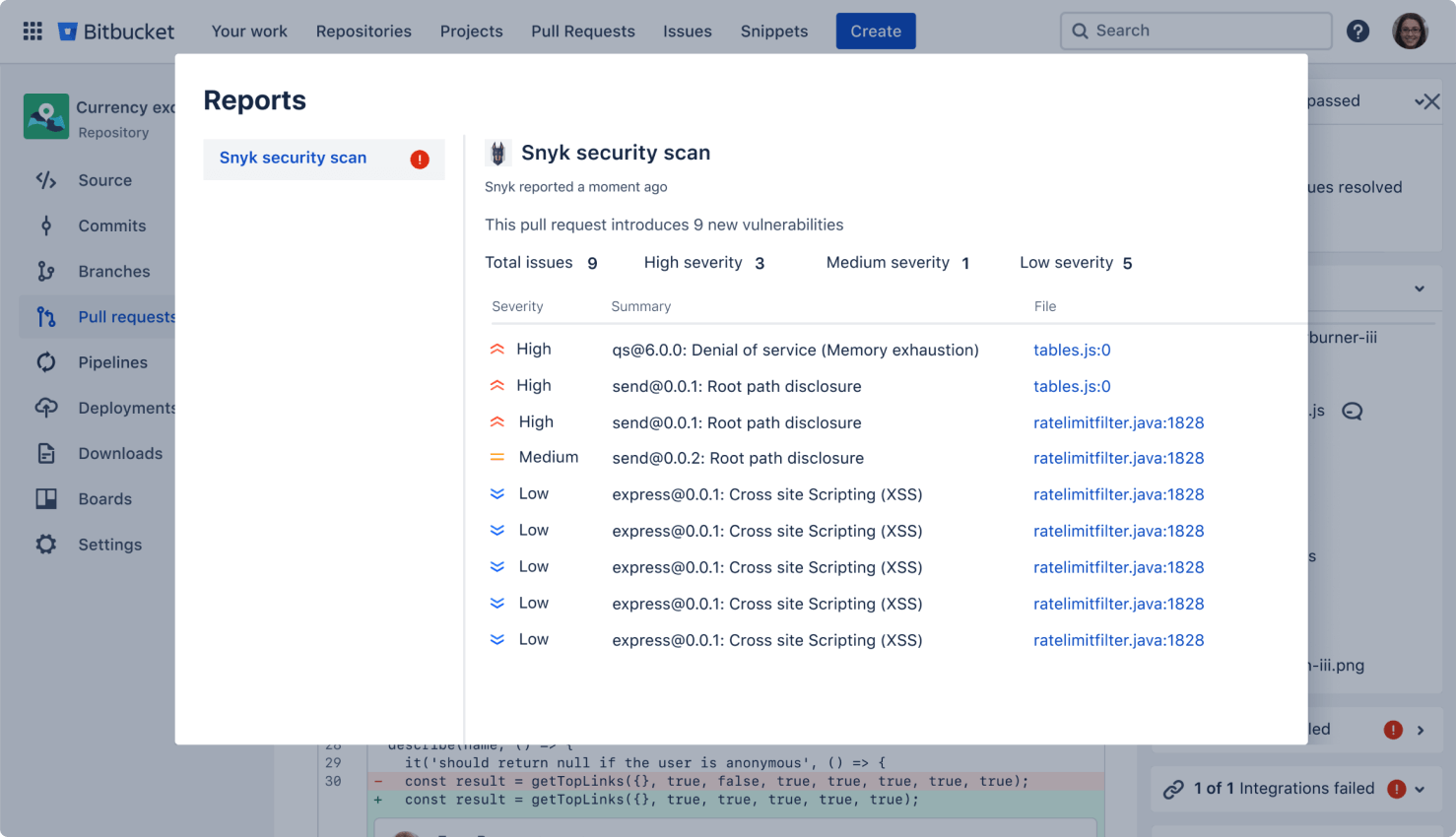

Technological Integration

At the forefront of innovation, STPN – Serviços Tributários dos Produtos Nacionais Ltda seamlessly integrates technology into its array of tax services. Recognizing the transformative power of technology, STPN employs cutting-edge tools and platforms to streamline processes, enhance efficiency, and provide real-time insights to clients. Automation and data analytics play a pivotal role, allowing STPN to offer not just compliance but a proactive approach to taxation. This technological synergy not only simplifies the tax journey for businesses but also positions them strategically in an era where digital integration is key. By leveraging technology, STPN ensures that its clients not only keep pace with regulatory changes but stay one step ahead, fostering a future-ready approach to national product taxation.

Expertise and Professionalism

At the heart of STPN – Serviços Tributários dos Produtos Nacionais Ltda lies a commitment to unparalleled expertise and professionalism. The company boasts a highly skilled team dedicated to delivering excellence in every facet of tax services. Their in-depth understanding of national tax regulations, coupled with a client-centric approach, ensures that businesses receive not just solutions but tailored strategies for long-term success. STPN’s professionalism extends beyond competence; it’s a commitment to exceeding client expectations, making them a trusted partner in the intricate landscape of national product taxation.

Conclusion

In conclusion, Stpn – Servicos Tributarios Dos Produtos Nacionais Ltda stands as an exemplar in the realm of tax services for national products. With a rich history rooted in dedication and adaptability, STPN has evolved into a comprehensive solution provider, offering not just services but strategic advantages for businesses. From its commitment to expertise and professionalism to a diverse service portfolio, STPN ensures that navigating the intricate world of national product taxation becomes a journey towards success. Businesses choosing STPN are not just complying with tax regulations; they are securing a partner committed to their financial prosperity in the ever-evolving business landscape.

Read More: shpp brasil instituicao de pagamento e servicos de pagamentos ltda

FAQs

Does STPN only cater to large corporations, or do they also serve small businesses?

STPN caters to businesses of all sizes, from small startups to multinational corporations. Their services are tailored to meet the unique needs of each client, regardless of size.

How does STPN stay up-to-date with changes in national tax regulations?

STPN has a dedicated team of professionals who closely monitor legislative developments and undergo continuous training to ensure they are well-versed in the latest changes to national tax laws and regulations.

Can STPN assist with tax planning for businesses operating in multiple jurisdictions?

Yes, STPN specializes in providing strategic tax planning solutions for businesses with operations in multiple jurisdictions. Their expertise in international taxation ensures that clients can optimize their tax structures and minimize liabilities effectively.

What sets STPN apart from other tax service providers?

STPN distinguishes itself through its unwavering commitment to professionalism, its team of highly skilled professionals, and its comprehensive range of services tailored to meet the diverse needs of its clients.

How can businesses get started with STPN’s services?

Businesses interested in availing themselves of STPN’s services can reach out via their website or contact their offices directly to schedule a consultation. STPN’s team will work closely with clients to assess their needs and develop customized solutions that address their specific tax requirements.